A HOME

Congratulations on embarking on the journey to find your dream home or investment property! Whether you're a first-time buyer or an experienced investor, navigating the real estate market can be exhilarating, and we're dedicated to ensuring it's a smooth and rewarding experience for you. In this guide, we've compiled essential information, expert tips, and valuable insights to empower you in your real estate endeavors. From deciphering market trends to understanding property listings, we're with you every step of the way.

Whether your ideal property is a suburban home, an urban loft, or a countryside estate, our aim is to provide you with the knowledge and resources necessary to make well-informed decisions that align with your preferences, lifestyle, and financial objectives. Welcome to your ultimate guide to real estate success!

The journey to homeownership begins by laying the groundwork for a successful experience, whether you're a first-time buyer or looking to upgrade. Start by defining your priorities and preferences, considering factors like location, size, amenities, and budget to streamline your search. Ensure your finances are in order by evaluating your budget, determining affordability, and getting pre-approved for a loan to strengthen your position when making offers. Enlist the support of professionals, including a trusted real estate agent, mortgage lender, and home inspector, to guide you through the process. With careful planning, financial preparedness, and expert guidance, your home-buying journey promises to be exciting and rewarding. Let's embark on this adventure together with enthusiasm and confidence!

We’re glad you found us. We’re looking forward to learning more about your home-buying needs. Passion-driven, results-oriented, and always straight-shooting, we let our track record speak for itself. Our team is deeply rooted in the communities that we serve and vested in helping our clients achieve their goals.

So much goes into purchasing a home. It can all feel overwhelming. We get it! The good news is that we’ve done this a few....maybe a few thousand....times before! We’re here to walk you through your entire home-buying journey.

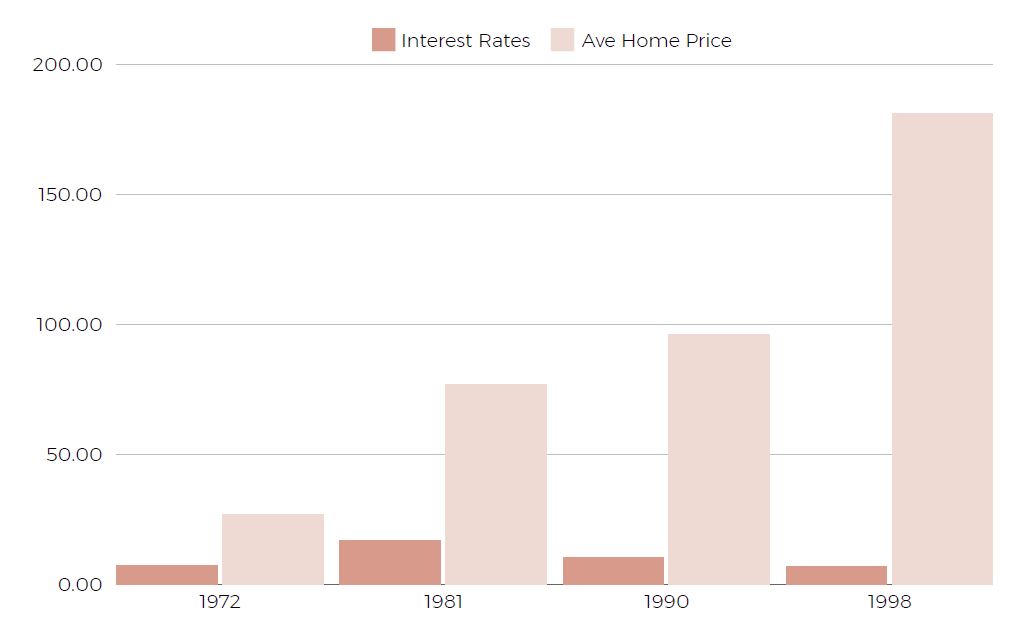

This is obviously the elephant in the room right now. Maybe you want to buy a home, but current interest rates make you nervous. This makes perfect sense, but if you can give us an opportunity to run through the numbers with you, the math is actually simple!

We can change your final interest rate to 5-6% by negotiating buydowns. What we cannot change is affordability and appreciation. Waiting for interest rates to come down just does not add up.

The chart below shows the trajectory of mortgage interest rates compared to average home prices in the Portland Metro area over 26 years. The 1972 Buyer who said they wanted to wait until rates came down would have had to wait for 26 years before that happened! That same Buyer lost out on a 700% return on their investment based on appreciation.

Preliminary Financing

Make a rough estimate of how much home you can afford based on your income and current debt. Lenders and financial experts recommend your monthly debts should be no more than 43% of your gross monthly income. An online mortgage calculator can help!

Know Your Credit Score

Your credit history is one of the principal measures used by a lender to determine your interest rate. The better your credit, the better the lending terms. You should obtain and review copies of your credit report from the three main credit reporting agencies. Improving your debt-to-income ratio will also help you qualify for better terms.

Now that you have done your initial homework, it’s time to meet with a lender to get pre-approved. If you need recommendations for a few great lenders, we can help! What’s the difference between a pre-qualification and a pre-approval?

Pre-qualification is a loan officer’s opinion that you can obtain financing. No verifications are made, so formal approval is not issued.

Pre-approval means the loan officer and underwriting team have more thoroughly reviewed your loan application. This means that your credit report has been pulled, and some assets and income have been verified.

Pre-approved Buyers are ahead in the home-buying game. A pre-approval letter from a lender provides an edge in multiple offer situations. It also confirms to the Seller that a Buyer is serious and will likely be able to close more efficiently.

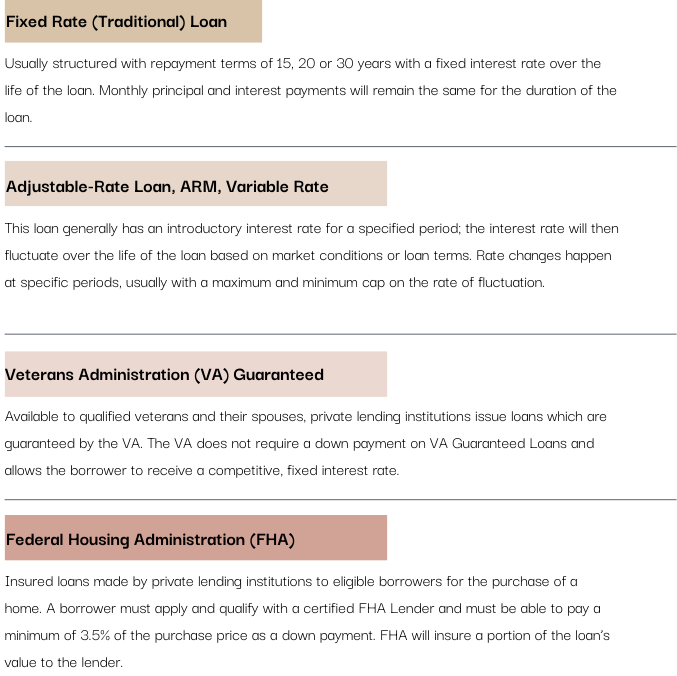

Not all home mortgages are structured the same. There are several borrowing options for home Buyers and the type of loan that you choose should work for your unique financial situation.

There are, of course, several costs involved with purchasing a home, other than your down payment. Some expenses are paid upfront, and others are collected at closing. Lending institutions are required to provide a borrower with a Good Faith Estimate of closing costs at the time of application, to eliminate any surprises.

Finding the right home is the fun part—location, location, location. Whether you are new to Portland or simply moving within the area, it’s so important to find the right neighborhood first. Almost anything about a home can be changed except its location. Here are some great tips to keep in mind when we begin your search.

ELIMINATION IS AS IMPORTANT AS SELECTION

MAP COMMUTE TIMES

DON'T BE PUT OFF BY INTERIOR DECORATIONS

NO HOME IS PERFECT

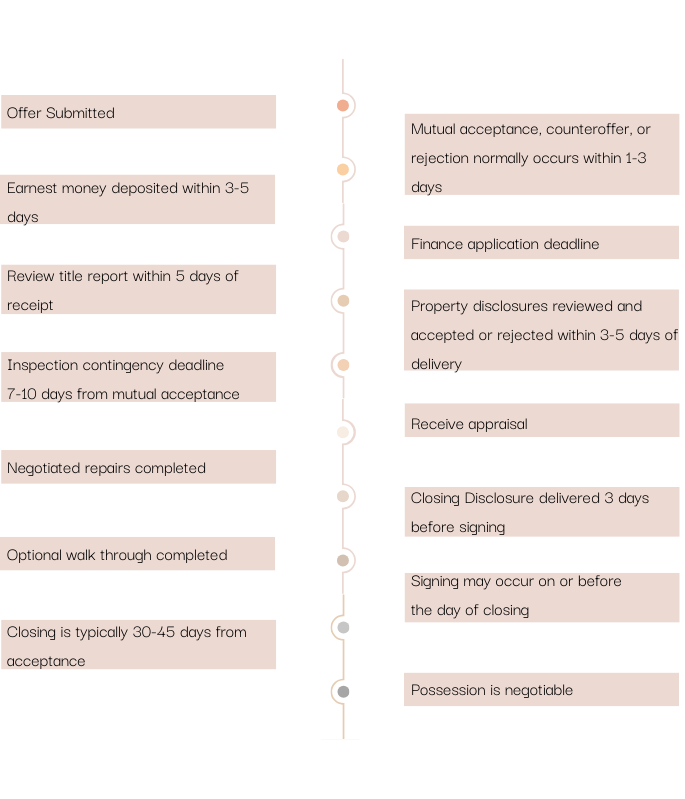

So much happens from when we enter into a binding contract until closing. Knowing that there is a lot to track, one of the first things we do is create a custom Transaction Portal where you’ll have access to all documents, a timeline, and a contact sheet with relevant details of each party involved in your sale.

As you continue on this exciting path towards discovering your dream home, please know that our team is here to assist you at every stage. Whether you have inquiries, require additional support, or simply wish to share your progress, we encourage you to reach out to us. We also have a comprehensive Buyer Guide to help you along the way. Your satisfaction and success remain our top priorities.